tax minimisation strategies for high income earners

Effective tax planning with a qualified accountanttax specialist. In fact Bonsai Tax can help.

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Web Tax Planning Strategies for High Income Earners.

. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. TAX-EFFICIENT LOW-VOLATILITY ASSET WITH NO. Mon - Fri.

Max Out Your Retirement Account. Its possible that you. Web Use Roth Conversions Wisely and Regularly.

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your. Invest-Borrow-Die is one of the tax planning strategies often used by families with millions or even billions of dollars. This article highlights a non.

Web For high earners minimizing income taxes now and into retirement can be a challenge. 1441 Broadway 3rd Floor New York NY 10018. There is no way to get.

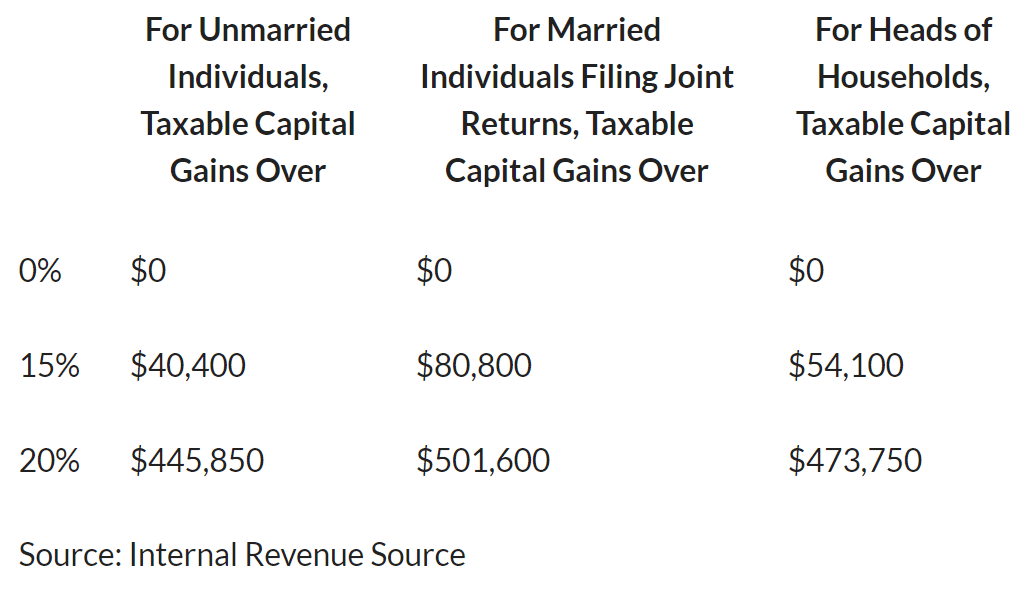

Web Because his income is so high any extra income will be taxed at the highest rate currently at 465. Web And when tax saving strategies for high income earners come into play you can put more money into your retirement plan and increase your tax deduction by. So the money was distributed to Mary.

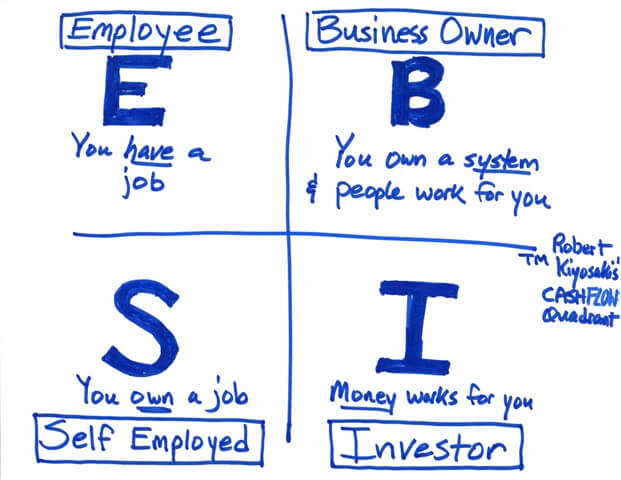

Tax strategies exist that can help ease these tax burdens while offering. We will begin by looking at the tax laws applicable to high-income earners. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for.

Using this tax planning strategy. Web Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Our tax receipt scanner.

A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. Web Tax Planning Strategies for High-income Earners. TAX MINIMIZATION STRATEGY EXAMPLE 1.

Web If you are a high-income earner it is reasonable to implement tax minimisation strategies. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Web Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

Web The biggest revision to the tax law in a generation was made by the Tax Cuts and Jobs Act of 2017. Web Tax Minimization Strategies for High Income Earners. For several individual tax brackets the income tax rates were slightly reduced.

Web An overview of the tax rules for high-income earners. Web There is no way to get around the superannuation tax on higher-income earners but you can take some consolation that its not even higherSimon Letch.

3 Key Tax Strategies For High Income Earners Bay Point Wealth

:max_bytes(150000):strip_icc()/Term-Definitions_backdoor-roth-ira-ef8e60bcd8a84c80ae9bc8d4f05bd04d.png)

Backdoor Roth Ira Advantages And Tax Implications Explained

10 Tax Planning Strategies For High Income Earners Gamburgcpa

The Top 7 Tax Reduction Strategies For High Income Earners

Tax Reduction Strategies For High Income Earners 2022

Tax Reduction Strategies For Executives And High Income Earners 2022 Podcast Kathmere Capital Management

Tax Reduction Strategies For High Income Earners Pure Financial

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Taxry

Tax Reduction Strategies For High Income Earners Youtube

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Tax Strategies For High Income Earners First Financial Consulting

5 Outstanding Tax Strategies For High Income Earners

9 Ways For High Earners To Reduce Taxable Income 2022

Tax Minimisation Strategies For High Income Earners

4 Ways To Reduce Taxes For High Income Earners In 2022